I frequently see businesses that are not profitable or have small profit. Usually, these owners are burned out and very frustrated and don’t know what to do to fix the situation. Here are some of the methods I use to help them. Heading into 2022 some of these problems are only getting worse including:

- QBO ACH Fees started in April – Zelle, Bank ACH, Venmo, Checks

- Labor shortage – understand revenue capacity constraints

- Labor costs increasing – Understand Monthly Cash Flow

High Level here are the 3 main levers I look at. I will cover each in detail below. They all sound simple enough but unprofitable businesses have trouble doing them –

- Increase Margin, which is typically done by raising prices or decreasing Cost of Good Sold

- Increase Scale, means sell more at the current margin to be able to cover your fixed costs like rent and any overhead salary

- Decrease overhead and fixed costs – look for ways to reduce costs and possibly improve processes and efficiency

Increase Margin

This is where most people start as the easiest way to improve profitability is to increase prices. When business owners start out they typically undercharge because they don’t know what the market rate is and they need customers so they feel like having a lower rate will help them. Older businesses may have charged a certain rate for a long time and are resistant or lazy to change.

Our top 3 tips to increase prices –

- Ask your competitors what they charge. Look at bigger firms that are successful and if you know the owner ask them. If you don’t know them then pretend to be a mystery shopper and ask them what they would charge.

- Trial it out. For your next prospect or lead try to sell them at a higher rate. You have little to lose since it is only a lead and as you sign new customers up it will increase your confidence

- Make it a habit to increase price every year. It will make you figure out the process of how to do it and will help you adjust for inflation each year

After you have the price in a good spot the next part is to decrease your Costs of Goods Sold. This is a little harder but there are ways to accomplish it –

- Look for ways to reduce the costs. If you are buying materials can you increase your order size order at the end of the quarter, change your payment terms, etc to get a discount. If your costs are labor look for ways to hire cheaper resources by training up less expericned staff or looking to hire people in India or the Philippines.

- Look for ways to automate and improve the efficiency of tasks. Is there software or things your customers can do to make your job easier?

- Analyze the productivity of staff and margin for different services and customers. Are there certain customers or type of business that do not make as much money. Can you charge more to cover the extra costs for your team or does it make sense to fire some of those customers?

Increase Scale

This is my favorite because it is often overlooked and not as easy to understand. For a lot of businesses they have a portion of costs that are pretty much fixed, which might include things like rent, utilities, admin salary, software costs, etc. If your business grows a lot then these costs may increase but not as fast as your gross profit. Your business would have to be a lot bigger before your rent increased unless you have already outgrown your space.

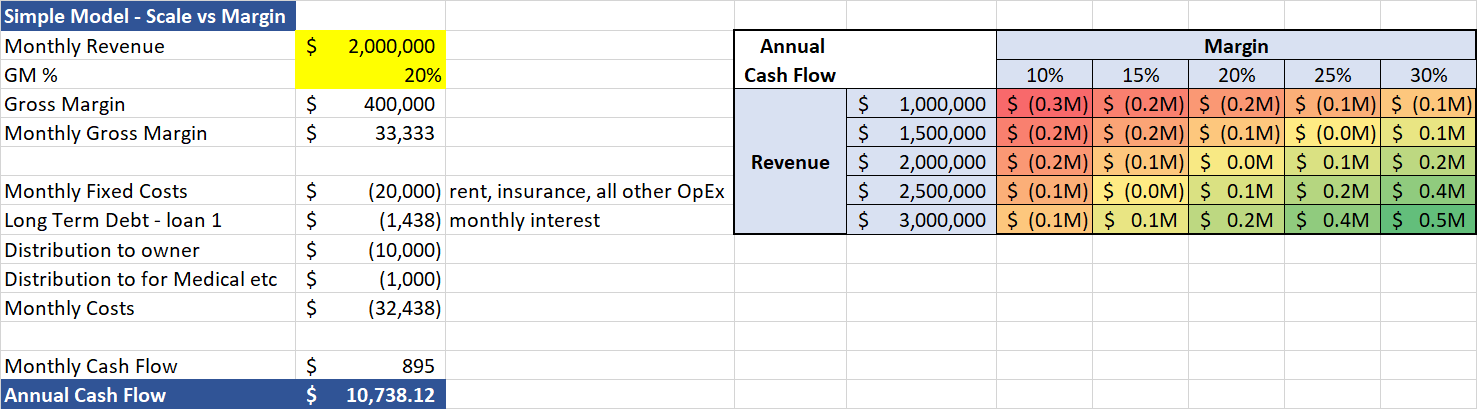

The easiest way to see this is to build a simple model and see how the profit changes based on your size. This model changes the two cells in yellow and then shows the Cash Flow in the Sensitivity Table. You can see that at 20% margin you lose $200K at a scale or revenue of $1M but at a revenue of $3M you make $200K.

It is also worth noting that model looks at cash flow instead of profit as there may be things like distributions to owners that are not captured in profit and loss statements. Let me know if you have questions on that or would like me to email you this simple model.

Ok great so now you understand that its important but how do you increase the scale? Well not so fast one quick clarifying point – if your margin was only 10% you could keep increasing the scale to $3M and you would still be losing money, so in that case you should go back to Increase Margin before you spend any money or resources on increasing scale as if you can’t improve the Margins then it might be better to close the business before you lose more money.

Here are some of the ways to increase Scale –

- Increase your Capacity – I see it a lot where people are booked a month out. If they were able to hire more staff then the staff could do that work and the revenues would increase. Also all of the opportunities that you pass on or that move on because of the 1 month waiting period will also increase your scale as you sell more 🙂

- The easiest way is to increase sales and marketing spend to get more customers. You will need to make sure your spend is optimized so that your cost to acquire a customer is less than 25% of the lifetime value of the customer (LTV to CAC > 4). You can hire marketing companies to help with this and if you need intros please let me know.

- You can ask current customers and referral networks for introductions to people that might need your services. If appropriate you can offer referral bonuses.

- Build your referral network. Analyze your current referrals and determine which types of people and groups refer the most and find ways to do more of that.

- Look for add on services – can you add consulting or administrative services to what you are selling? If you are are a CFO firm can you add bookkeeping and tax 🙂

Decrease Overhead and Fixed Costs

This is important but I feel less important than the other strategies. Every month and year you should look at your operations costs and see if there are any costs that are increasing or that seem high. Are there small things like bank fees or subscriptions that you no longer need? Are there bigger things that you need to look at like marketing costs to see if they need to be optimized to be more efficient? Can you outsource your accounting to 1 part time resource instead of 1 full time resource? Quick story here – we are working with a company that had 4 full time accounting staff and after improving processes to be more efficient (less date entry, less manual and duplicate reports) they were able to reduce to less than 2 full time staff.

Final Thoughts

Increasing profits is something that you or someone on your team should be looking at. It is an ongoing process and not something you do once are and are finished. You should constantly be modeling as you hire new staff or spend more on marketing to see if you are headed the direction you want to go. If you need any help or have questions then please send us an email to paul@financepals.com.